Fleet mileage tracking

Take the hassle out of trip administration with digital mileage tracking

Our digital mileage logbook helps you maintain accurate, easy-to-use mileage tracking and administration for company vehicles, grey fleet drivers and pool-car fleets, while protecting your drivers’ data privacy.

Webfleet Logbook helps you:

Create individual driver profiles

to manage your drivers in pool-car vehicles

Simplify fleet administration

for taxes, cost control and complying with HMRC

Reduce your workload

with accurate odometer reading directly from vehicle’s odometer1

Reduce your drivers' workload

with automatic business and private trips registration

Prove tax compliance

with reliable and accurate data

Protect your drivers’ privacy

when they use company vehicles for personal journeys

Key features of fleet mileage tracking

Automated trip recording

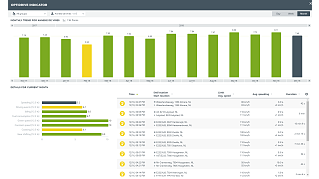

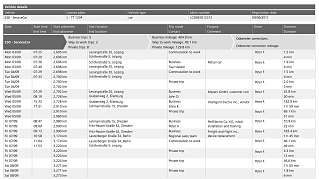

Trip and mileage tracking reports provided by Webfleet can be used for mileage claims and tax detail verifications. All of this helps you reduce your tax burden and cut the time you spend on trip administration.

Heightened data security for drivers

We take data privacy seriously. That’s why drivers can only see details of their own trips and companies have the option to hide trace for business and private trips.

Satisfy HMRC compliance

Our automatic mileage tracking solution ensures employee benefits are taxed accurately. This also helps with compliance for HM Revenue and Customs (HMRC) auditing purposes, which require mileage log documentation to be saved for a minimum of 5 years.

Driving behaviour feedback

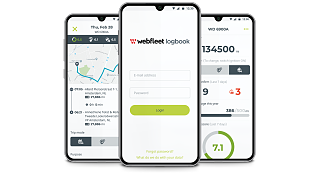

Driver scores (OptiDrive) are presented on both the PRO Driver Terminal and Webfleet Logbook mobile app. This helps drivers stay safe and reliable on the road, while maintaining a good reputation for your business.

Easy-to-use mobile app

Drivers can manage their trip and mileage tracking administration with the user-centric Webfleet Logbook mobile app. While on the go, they can modify all trip details (such as contact person and purpose of journey), assign themselves to available vehicles, adjust the odometer settings and get driver feedback (OptiDrive).

Accurate, reliable data

Odometer data is updated in real-time directly from the vehicle’s odometer. So, when the tax authorities make a request you know your reports are reliable. Your trip report can be downloaded at any time in Webfleet or in the mobile app.

All you need to know about mileage tracking

What does mileage tracking do?

0

What does mileage tracking do?

0Mileage tracking is a general term for logging miles travelled for business. This can be done for a number of different reasons, including complying with regulations, tax or reimbursement of employees. This is useful and, in some cases, mandatory for numerous business types.

Essentially, all the miles that an employee drives for business purposes are tracked and recorded. This can be done via a number of different mileage tracking systems, from manual paper-based processes to excel spreadsheets to digital mileage solutions that automate the entire process. Let’s consider this last one in more detail.

What are the benefits of automatic mileage tracking?

0

What are the benefits of automatic mileage tracking?

0Whether you’re a driver or a fleet manager, keeping track of mileage is unlikely to be your core responsibility. Therefore, you probably don’t want to spend a huge amount of time either filling out paperwork or updating spreadsheets in order to stay on top of it.

This is why more and more companies are now turning to automatic mileage tracking solutions. These solutions will accurately take care of the mileage administration for your company vehicles, taking manual work off your plate and freeing you to concentrate on core business.

Also, as a business it’s your responsibility to store accurate records of business and private mileage for your vehicles. Failure to do so could lead to an Income Tax and Class 1 NIC penalty based on any inaccurate mileage claims. Using a mobile tracking app with digital storage helps you avoid costly fines.

How does a mileage tracking app work?

0

How does a mileage tracking app work?

0Let’s say you have a fleet of pool cars. A top-of-the-line mileage tracking app will create a profile for each of the drivers in your fleet. The driver can then manage their trip administration via the mobile app, easily logging key information such as purpose of journey, vehicle used, odometer setting and more. Some apps will even provide feedback on driving performance.

The odometer data is then updated in real-time straight from the vehicle’s odometer. All the data from the trip can then be stored, where it can be easily accessed by the fleet manager for mileage claims and tax detail verifications.

Why use a mileage tracking app for business?

0

Why use a mileage tracking app for business?

0Simply, a high-quality mileage tracking app makes life easier for drivers and fleet managers. Administration is simplified with more of your manual tasks automated. That means both driver and manager can give their full attention to other crucial tasks, increasing efficiency and decreasing stress levels.

There’s also the peace of mind of knowing that essential tasks are being handled by a reliable, consistent system. If and when tax authorities wish to audit your records to ensure your employee benefits are being accurately taxed, the reliable accuracy of your mileage tracking app’s records will come in very handy. Another crucial task taken care of!

As mentioned above, some mileage tracking apps will also provide feedback on how the driver is performing. For example, Webfleet Logbook offers driver feedback via the OptiDrive 360 system, which tracks key driving behaviours like speeding, driving events, idling, fuel consumption, constant speed, coasting and more. This data helps the driver work both more safely, more cost effectively and more sustainably on the road.

It is important, however, to take note of how any mileage tracking app you may utilise will manage the driver’s privacy. For example, a high quality mileage tracking app will give the driver the option to hide vehicle tracing if they are using their company vehicle for a private trip. Also, you want to be sure that your app provider is storing all your trip and driver data in the securest possible manner.

What is the right mobile tracking app for you?

0

What is the right mobile tracking app for you?

0Depending on the company, the set of functionalities and features required from a mobile tracking app will differ. It might be the case you need only the very basic trip data, it might be the case you need something deeper and more impactful.

Whatever your requirements, it’s worth keeping in mind the core reason for using a mileage tracking app is to make life easier. So, it’s key that any app you adopt for this purpose is built with user friendliness in mind. Find an app with a user-centric layout that both you and your drivers are comfortably using and will not take too much time out of their day.

Webfleet developed the Webfleet Logbook app to help businesses like yours track and manage their mileage data effectively. If you’re looking to take the hassle out of trip administration, we’d love to help you do it. Get in touch with one of our mileage experts today and find out what we can do for you.

Why switch to digital mileage tracking?

Learn more about how digital mileage tracking with Webfleet Logbook helps make you tax smart.

What you need for Webfleet Logbook

LINK vehicle tracking device

Webfleet subscription

The Webfleet Logbook mobile app

Your consent is required

In this section, external content is being embedded from .

To display the content, your consent is required for the following cookie categories:

- Targeted Advertising

- Analytics & Personalization

- Essential

For further details, please refer to our privacy policy. If you are interested in how ###vendor_name### processes your data, please visit their privacy policy.